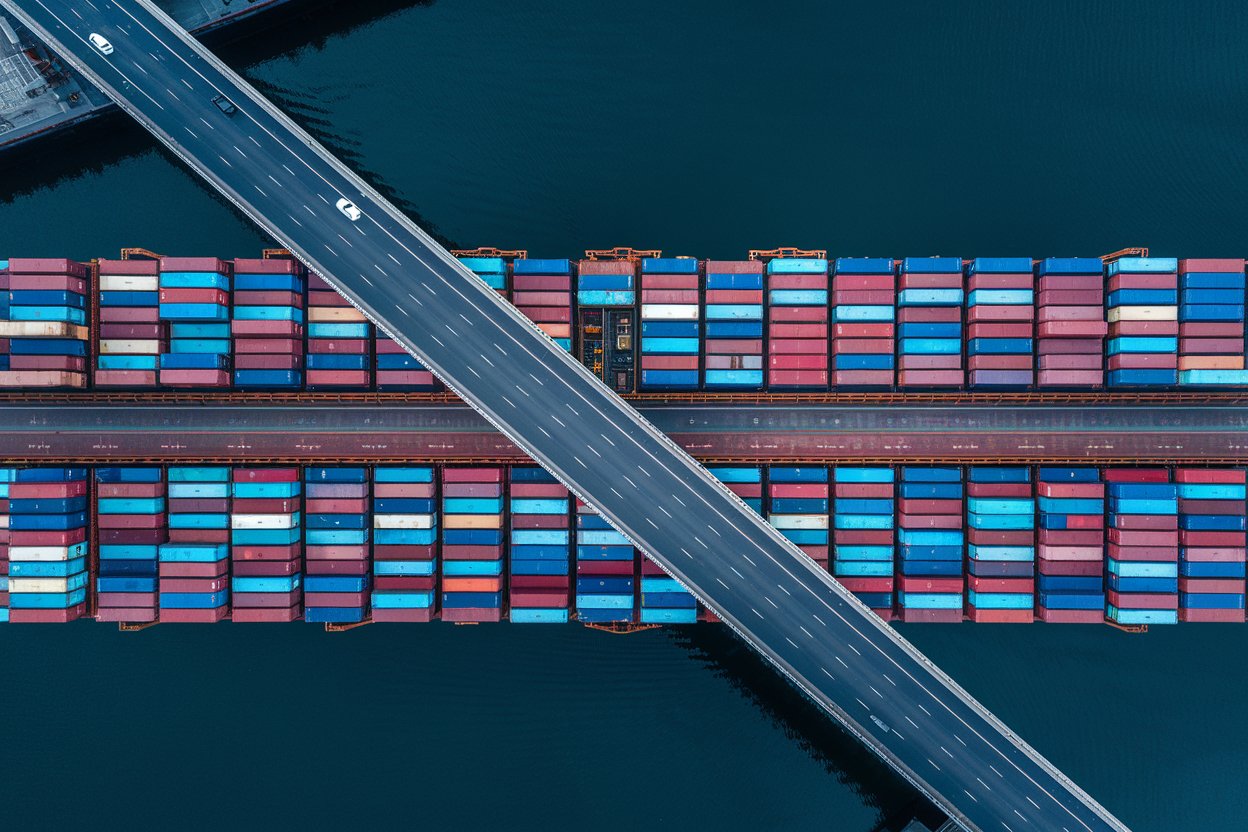

- 20 Years of Expertise in Import & Export Solutions

- +86 139 1787 2118

1. How to choose a reliable customs declaration agency?

When selecting a customs declaration agent, the following key factors should be prioritized for evaluation:

- Qualification verification:Check the customs-issued registration certificate for the customs declaration enterprise (valid until 2026).

- Industry experience:Prioritize agencies with experience in handling similar products (e.g., hazardous packaging certification experience required for chemical products).

- Service Network:Confirm that it has a stable operational team at the target port (especially newly opened ports such as the Hainan Free Trade Port).

- Compliance Record:Check past administrative penalty records through the Customs Enterprise Credit Management System.

II.?Customs Declaration?What core documents need to be prepared?

The basic customs declaration documents required by the General Administration of Customs in 2025 include:

- Commercial Invoice (must indicate the latest HS code for 2025)

- Packing List (Gross and Net Weight Required to be Accurate to Two Decimal Places)

- Power of Attorney for Customs Declaration (Electronic Signatures Have Been Fully Popularized)

- Transport documents (?Ocean shipping?Please provide the new version of the electronic manifest number)

- Special proof documents (e.g.Medical Devices(Requires the latest version of CE certification)

III. How are the service charges for customs declaration agency calculated?

The cost structure typically includes:

- Charged at 0.8% - 1.2% of the cargo value800-1500 yuan per ticket (varies by port)

- Additional fees:

- Inspection service fee: 200-500 yuan/time

- Express Processing Fee: Starting from 1000 CNY

- Document Translation Fee: 80 RMB/page

- Government statutory fees:Customs inspection fees, port miscellaneous charges, and other actual expenses will be reimbursed based on the actual costs incurred.

IV. What are the latest considerations for electronic customs declaration?

Starting from January 2025, the new electronic customs declaration regulations will be fully implemented, requiring:

- It is mandatory to use a third-party data encryption transmission system certified by the General Administration of Customs.

- The electronic signature must comply with the Electronic Signature Law of the People's Republic of China (2024 Revision).

- The application for amendment of the customs declaration must be submitted at least 6 hours before the release of the goods.

- ?E-commerce?Additional digital certification from the trading platform is required for B2B exports.

V. How to Avoid Legal Risks in the Customs Declaration Process?

It is recommended that enterprises establish a triple safeguard mechanism:

- Pre-review:Regularly update the commodity classification database (referencing the 2025 version of the Harmonized System).

- Process monitoring:Request the agency to provide real-time customs clearance status tracking.

- Post-event traceability:Maintain complete customs declaration records for at least 5 years (including electronic data).

6. What should you do when encountering customs inspection?

Standard operating procedures for professional agency firms:

- Complete the receipt of the inspection notice within 1 hour.

- Please prepare the original copies of the relevant documents within 4 hours.

- Arrange for a licensed customs declarer to provide on-site assistance (must bring the new version of the customs declarer IC card).

- An inspection analysis report will be issued within 48 hours.

7. How does customs clearance efficiency impact export operations?

According to the 2025 customs statistics:

- The average time required for normal customs declaration is 1.8 working days.

- Delays caused by documentation issues account for 37%.

- For each day of delay, an additional cost of 0.5%-1% of the cargo value will be incurred.

- The customs clearance speed for AEO Advanced Certification enterprises has increased by 40%.

8. How to evaluate the service quality of a customs declaration agent?

It is recommended to adopt the KPI assessment system:

- Customs declaration accuracy rate (target value ≥99.5%)

- Abnormal response speed (30-minute feedback mechanism)

- Annual Compliance Audit (a third-party audit report must be provided)

- Customer Satisfaction (Quarterly Follow-up Scoring System)

? 2025. All Rights Reserved.